Trump and Harris’ Sharply Different Views on the Economy

Former President Donald Trump is set to present his economic plans to the Economic Club of New York, arguing that he can reduce prices for Americans by deregulating and increasing fossil fuel production during a potential second term. He aims to contrast his policies with those of his opponent, Vice President Kamala Harris, who he claims would deter large companies from operating in the U.S. Trump has proposed lowering the corporate tax rate from 21% to 15%, a move favored by businesses, while Harris advocates for raising it to 28%. Both candidates have different visions for managing the economy, which is a central theme in the current election. An AP-NORC poll indicates Trump slightly leads Harris in perceived competence on economic issues. Trump’s plans to impose tariffs to return manufacturing jobs have been met with skepticism from economists who warn they could exacerbate inflation, which peaked at 9.1% in 2022 but has since decreased. Harris, meanwhile, is focused on stimulating entrepreneurship by easing the process for new businesses and advocating for generous tax deductions related to startup costs.

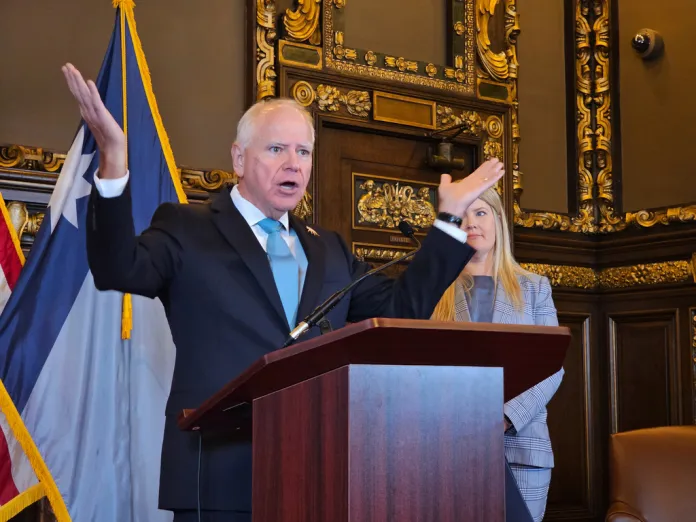

Former President Donald Trump will go before a group of economists Thursday to make his case that he can bring down prices for Americans by lifting regulations and boosting production of fossil fuels in a potential second term.

The GOP presidential nominee is speaking to the Economic Club of New York a day after appearing in a town hall on Fox News, where he argued that his opponent, Vice President Kamala Harris, would drive large companies away from the U.S. if she wins the election.

Trump has floated the idea of chopping the 21 percent corporate tax rate to 15 percent, a proposal liked by companies, in addition to no taxes on tips and Social Security income. The corporate rate had been 35 percent when he became president in 2017, and he later signed a bill lowering it.

Trump and Harris, the Democratic nominee, want to take the rate in opposite directions while arguing that each is better than the other for American business. It is one of the many ways the two major-party nominees have laid out sharply different views on the economy, a critical issue in this year’s election.

Trump had a slight advantage over Harris on which candidate would better handle the economy, according to an AP-NORC poll conducted in August. Some 45 percent of adults said Trump would do a better job, and 38 percent said Harris.

Harris calls for raising the corporate tax rate to 28 percent from 21 percent. Her policy proposals this week have been geared toward promoting more entrepreneurship, a bet that making it easier to start new companies will increase middle class prosperity.

Economists have warned about Trump’s plans to impose tariffs that he says would return manufacturing jobs to the U.S. Some have said such taxes on imports could worsen inflation, though he is vowing to cut down costs. Inflation peaked in 2022 at 9.1 percent, but has since eased to 2.9 percent as of last month.

President Joe Biden’s administration preserved the tariffs on China introduced under the Trump administration and banned exports of advanced computer chips to China.

Harris favors a top capital gains rate of 28 percent, whereas Biden has wanted to nearly double the existing rate to 39.6 percent on investors making more than $1 million. Both also want to increase a separate tax rate on investment income.

In New Hampshire on Wednesday, Harris called for expanding tax deductions tied to the expenses of starting a business and set a goal of 25 million applications to form new companies over the next four years.

The Western Journal has reviewed this Associated Press story and may have altered it prior to publication to ensure that it meets our editorial standards.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."