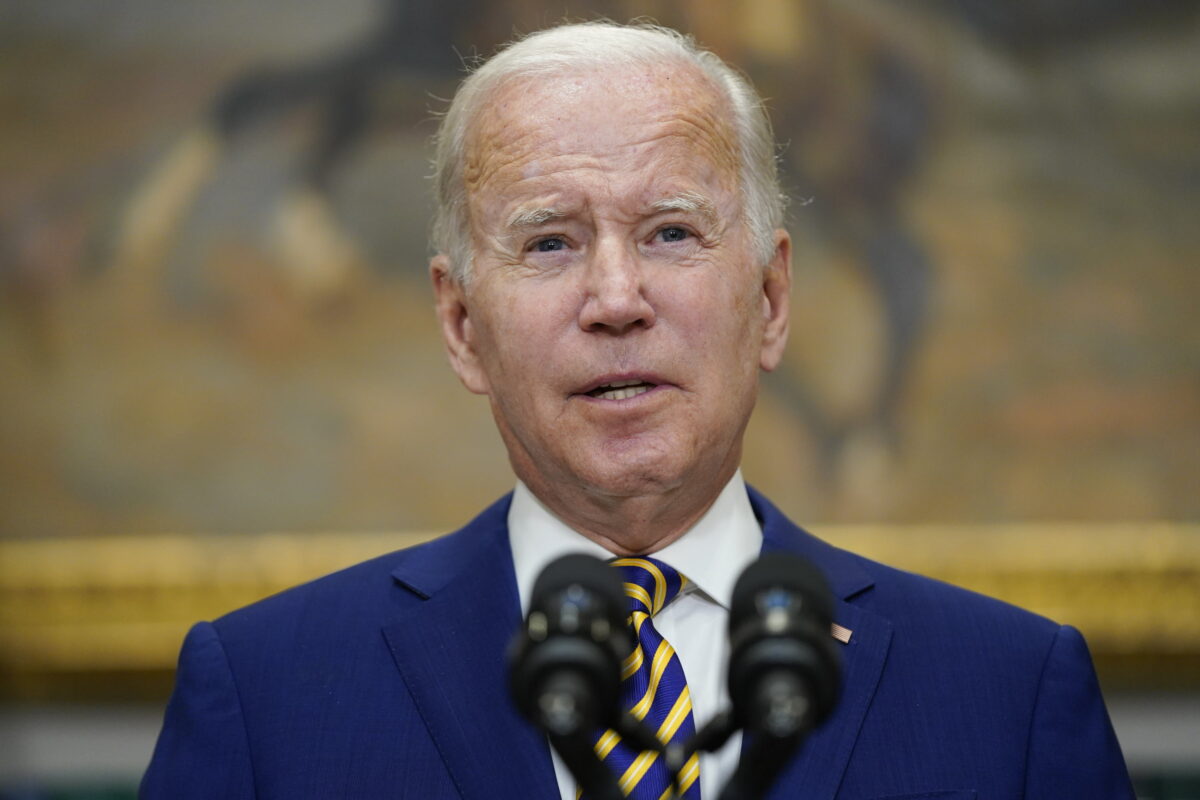

Biden’s student loan forgiveness policy under scrutiny.

President Biden’s Student Loan Forgiveness Program Under Scrutiny

The fate of President Joe Biden’s student loan forgiveness program hangs in the balance as lawmakers vote on a resolution to stop the program and end the pandemic-related pause on federal student loan payments.

The House Education Committee held a hearing on May 24 to examine the Biden administration’s student loan forgiveness policies. The proposed forgiveness program promised to eliminate up to $20,000 in federal student debt to millions of borrowers. The pause on payments was instituted in March 2020 in the early stages of the COVID-19 pandemic and is set to end later this year.

Republicans contend that the program is unlawful and transfers the debt’s cost to taxpayers who did not attend college or have paid off their student loans. The Congressional Budget Office (CBO) reported that blocking the program could decrease the federal deficit by about $320 billion.

The Supreme Court is expected to announce its ruling on the lawsuits in late June or early July.

Overstepping Authority

Rep. Burgess Owens (R-Utah) is chairman of the Higher Education and Workforce Development subcommittee. James Kvaal, who is the U.S. Department of Education’s Under Secretary of Education, and Richard Cordray, who is chief operating officer of the Education Department’s Office of Federal Student Aid, testified at the hearing and urged support for the student loan forgiveness program.

In his opening statement at the hearing, Owens said, “We titled the series, ‘Breaking the System,’ because that is exactly what the Biden administration is attempting to do. Mr. Cordray and Mr. Kvaal, the Department of Education has vastly overstepped its authority. You are operating under complete executive fiat. Upon my reading of the Constitution, nowhere are Congress’ legislative powers delegated to federal agencies like the Office of Federal Student Aid.”

The Education Department, Owens argued, has “submitted billions of dollars of regulations completely reshaping postsecondary education. When in the world did unelected bureaucrats at the Department of Education and so-called nonpartisan leaders at Federal Student Aid become legislators?

“The Department’s actions are not a fix,” Owens added. “Instead, they only exacerbate the long-term structural problem of college costs.”

The Congressional Budget Office recently estimated that the Biden administration’s Income-Drive Repayment (IDR) plan will “lead to a 12 percent increase in student borrowing largely due to increases in tuition,” Owens explained.

“It is the taxpayer who will ultimately foot the bill for this reckless proposal. Taken together, Biden’s student loan scam could cost taxpayers up to a trillion dollars when all is said and done.”

Conclusion

The future of President Biden’s student loan forgiveness program remains uncertain as lawmakers and the Supreme Court continue to debate its legality and effectiveness. Stay tuned for updates on this developing story.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."

Now loading...