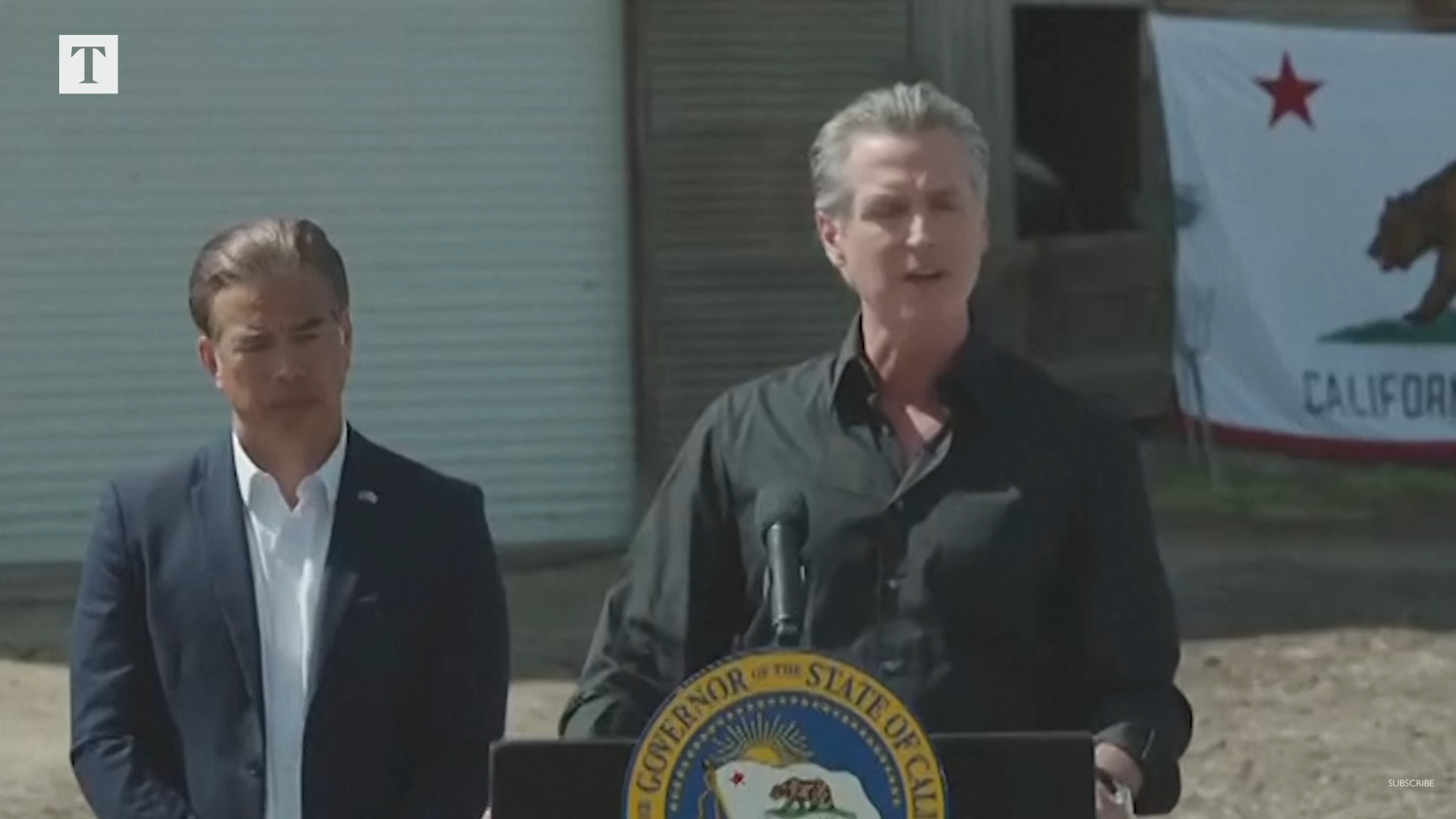

Gavin Newsom Celebrated SVB Bailout Without Mentioning His Wineries Are Clients

California Democratic Gov. Gavin Newsom We cheered on the federal government’s decision for protection Silicon Valley BankWithout mentioning that he is one,’s depositors.

Newsom was highly appreciative of the Biden government’s Sunday announcement that the Federal Deposit Insurance Corporation would cover all losses resulting from the Silicon Valley Bank collapse. SVB’s largest depositors weren’t surprised by the bailout. FDIC insurance covers only $250,000 per account.

Newsom is believed to be looking at a White House run in the event that President Joe Biden withdraws. Statement Sunday will be the “Biden Administration has acted swiftly and decisively to protect the American economy and strengthen public confidence in our banking system.”

“California is a pillar of the American economy, and federal leaders did the right thing, ensuring our innovation economy can continue to grow and move forward,” The governor of California said.

Newsom claimed that the FDIC decision would have been a good one. “profoundly positive impacts” California businesses but he didn’t mention that his own wineries might be able to benefit from the FDIC’s unusual actions, according to The Intercept. Newsom-owned wineries CADE Winery, Odette and PlumpJack all had SVB accounts. Each of these accounts was at risk of losing their deposit if they held more than $250,000 in one account.

A source said that Newsom also maintained personal accounts at this bank.

“Governor Newsom’s business and financial holdings are held and managed by a blind trust, as they have been since he was first elected governor in 2018,” In an email, a Newsom spokesperson informed The Intercept that he was speaking on behalf of the senator.

After Newsom coordinated directly with the White House, and other high-ranking officials, the Biden administration and FDIC decided to backstop all Silicon Valley Bank deposits.

“Over the last 48 hours, I have been in touch with the highest levels of leadership at the White House and Treasury. Everyone is working with FDIC to stabilize the situation as quickly as possible, to protect jobs, people’s livelihoods, and the entire innovation ecosystem that has served as a tent pole for our economy,” Newsom Saturday. He didn’t say what the conversations were about.

Newsom also has other connections to SVB. Jennifer Siebel Newsom’s spouse, was the founder of California Partners Project. In 2021, SVB donated $100,000 to this charity. John China, president of SVB Capital sits on this charity’s board.

Before it collapsed last week, SVB was America’s 16th largest bank. $175 billionCustomer deposits in excess of $250,000 More than 90% of these deposits exceeded the FDIC’s $250,000 threshold to be guaranteed insurance.

FDIC is an independent agency funded by premiums banks and financial institutions pay for FDIC insurance. The FDIC’s Deposit Insurance Fund ended last year. Held $128.2 billion.

“From Gavin Newsom Celebrated SVB Bailout, Without Mentioning His Wineries are Clients“

“The views and opinions expressed here are solely those of the author of the article and not necessarily shared or endorsed by Conservative News Daily”

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."

Now loading...