Hunter Biden whistleblowers blast IRS for moving to block them from lawsuit – Washington Examiner

In a recent legal development, IRS agents Gary Shapley and Joseph Ziegler have accused the agency of attempting to block their participation in a lawsuit filed by Hunter Biden against the IRS. The agents, who have previously raised concerns about the IRS and DOJ allegedly stalling an investigation into Biden to protect his father, President Joe Biden, seek to intervene in the lawsuit to defend their actions and reputation, claiming that the IRS has retaliated against them. Biden’s lawsuit alleges that the agents illegally disclosed his confidential tax information, while the agents argue that their information was made public by Congress. They plan to ask the court to dismiss the lawsuit in its entirety, highlighting a perceived conflict of interest within the IRS. This case underscores ongoing tensions and accusations involving whistleblower protection and agency retaliation in high-profile investigations.

Hunter Biden whistleblowers blast IRS for moving to block them from lawsuit

A pair of Internal Revenue Service agents once involved in the federal investigation of Hunter Biden accused their employer of improperly attempting to shut them out of a lawsuit between the first son and the IRS, according to court papers filed Wednesday.

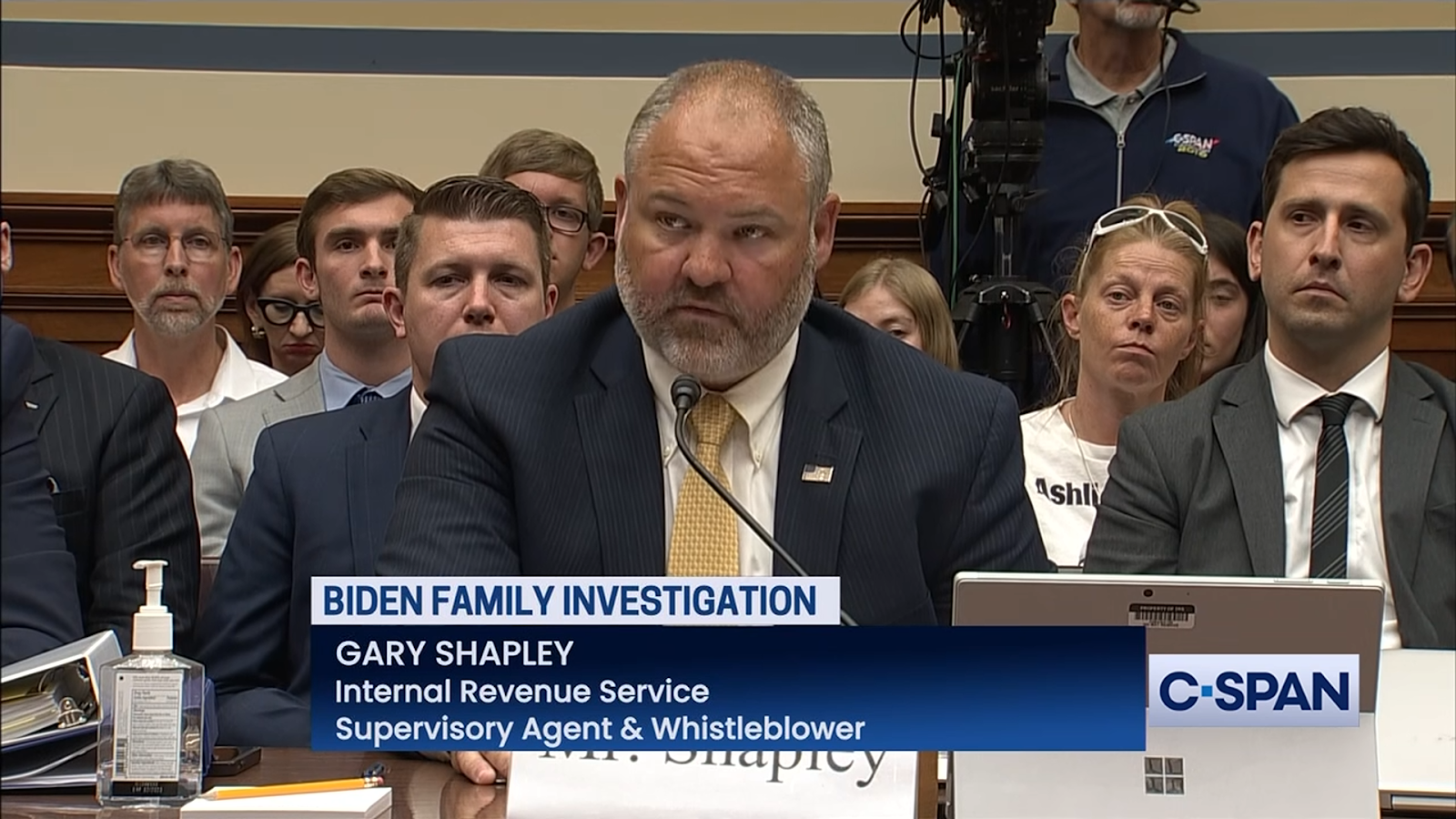

The two veteran IRS criminal investigators, Gary Shapley and Joseph Ziegler, argued through their attorneys that they should be permitted to intervene in the lawsuit that Hunter Biden brought against the IRS in September 2023.

“When coupled with the fact that the IRS has already retaliated against Shapley and Ziegler, it is hardly a stretch to say the IRS has an inherent and institutional conflict of interest that at the very least should be remedied by permitting Shapley and Ziegler to intervene and to raise appropriate arguments for this Court’s consideration,” the attorneys wrote.

Shapley and Ziegler approached Congress last year with allegations that the IRS and the Department of Justice Tax Division were slow-walking a yearslong investigation into Hunter Biden to protect President Joe Biden. Congress publicized the allegations and worked with Shapley and Ziegler to glean information about the federal inquiry into the first son.

Hunter Biden later brought the lawsuit against the IRS, alleging Shapley and Ziegler did not partake in protected whistleblower activity by bringing their claims to Congress but rather illegally disclosed his confidential tax information.

Abbe Lowell, Hunter Biden’s attorney, pointed to numerous “non-congressionally sanctioned” media interviews Shapley and Ziegler gave. The pair of agents countered that any information they gave in the interviews was already made public by Congress and was therefore no longer confidential.

Shapley and Ziegler’s attorneys wrote that the pair want to intervene in the lawsuit to properly defend their actions and reputation because the IRS, in their view, has not done that.

“Indeed, at its core, all that granting the pending motion does is enable this Court to consider arguments not raised by Hunter Biden or the IRS,” the attorneys wrote.

The attorneys said they would, if permitted to intervene, ask the court to toss out Hunter Biden’s lawsuit in its entirety after the IRS only moved to dismiss a portion of it.

Jason Foster, an attorney at Empower Oversight, a group that advocates on behalf of whistleblowers and has been aiding the IRS agents, told the Washington Examiner the IRS’s efforts to keep Shapley and Ziegler out of the lawsuit is another example of the agency’s “active retaliation” against the pair.

Foster gave examples of retaliation he said Shapley has already experienced from the IRS. Shapley’s work circumstances have been “substantially changed” through “subtle” moves, such as being taken off the Hunter Biden investigation last year, needing added levels of approval on his work, and being passed over for a promotion, Foster said.

The IRS, for its part, asked a judge to deny Shapley and Ziegler’s intervention request, saying the agency is the one being sued for damages and, therefore, should have full control over the legal defense strategies in the case.

Shapley and Ziegler “do not have a legally protected interest in this case, and permitting them to intervene would unnecessarily delay this case and cloud the issues central to Plaintiff’s claims against the government,” attorneys for the IRS wrote in a separate court filing.

Shapley and Ziegler’s attorneys shot back that “unless the IRS’s ‘litigation strategy’ is not to prevail in this case, it begs the question of why the IRS opposes enabling the two people whose conduct is at issue to have a seat at the table.”

The attorneys said the pair of agents’ reputations and careers are on the line as they believe Shapley and Ziegler could lose their jobs as one side effect of the lawsuit.

Outside of the lawsuit, Ziegler and Shapley have brought their concerns that the IRS has retaliated against them to the attention of the Office of Special Counsel in the form of a complaint, and that case is still pending.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."

Now loading...