New bill prohibits IRS from using taxpayer funds to purchase firearms.

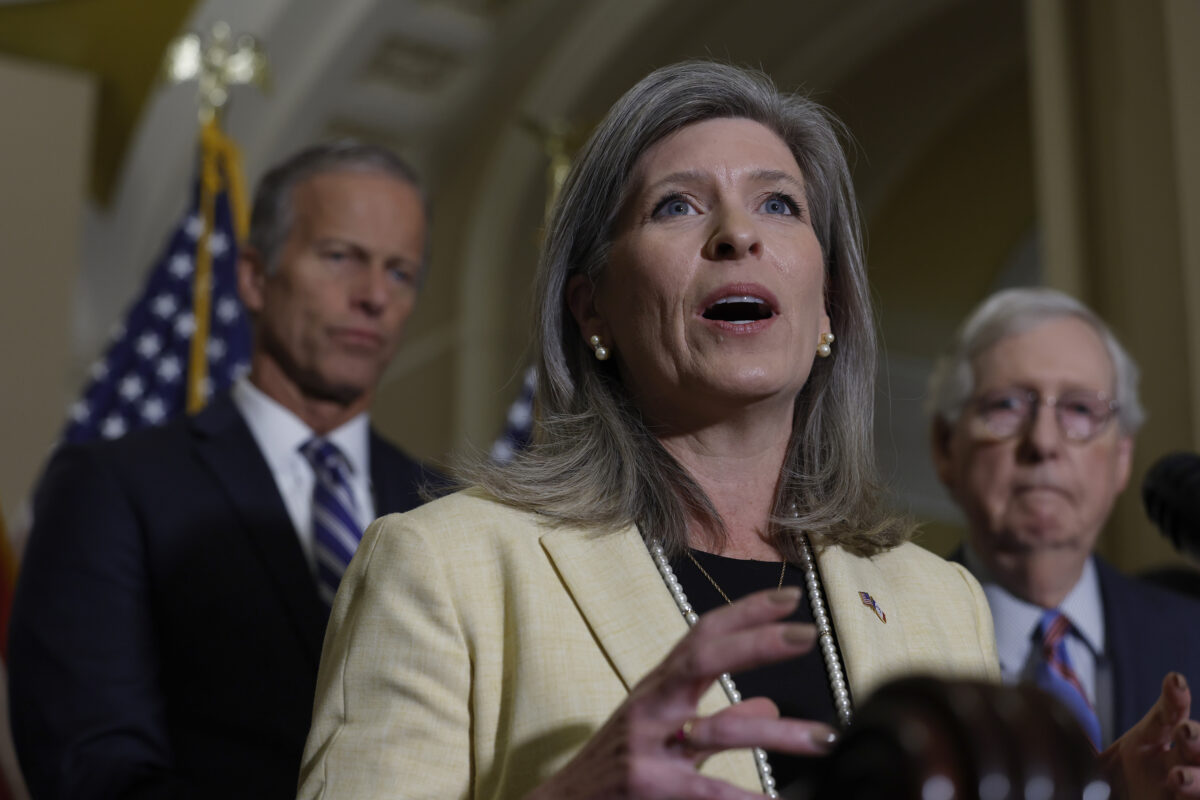

Senator Joni Ernst Introduces Bill to Disarm IRS Agents

Senator Joni Ernst (R-Iowa) has introduced a bill that would prevent the Internal Revenue Service (IRS) from using taxpayer money to purchase arms and ammunition for its agents. The proposed legislation would also require the transfer of any firearms and ammunition currently in the possession of the IRS to the General Services Administration for auction.

“The taxman is fully loaded at the expense of the taxpayer. Any further weaponization of this federal agency against hardworking Americans and small businesses is a grave concern. I’m working to disarm the IRS and return these dollars to address reckless spending in Washington.”

The bill would also relocate the IRS’s Criminal Investigation Division, the agency’s armed wing, to the Department of Justice.

Senator Ernst’s office cited OpenTheBooks, which found that the IRS spent millions of taxpayer dollars on firearms and ammunition, including AR-15-style rifles, semi-automatic shotguns, and “submachine guns.” The organization also discovered that the IRS had stockpiled over 5 million rounds of ammunition.

“The IRS special agent is starting to look less like a desk worker or rule maker and more like a SWAT team from a Hollywood thriller. It’s the blurring of the lines between a tax agency and traditional law enforcement.”

Last year, the IRS faced criticism after posting a job description for a special agent position that would require the agent to potentially use “deadly force.”

The proposed legislation comes after President Joe Biden and some Democrats announced a plan to expand the IRS, which Republicans say would entail hiring 87,000 new employees over the next decade and increasing funding by $80 billion. The funding was secured under last year’s Inflation Reduction Act, which Biden signed into law.

Why the Concern?

Many Americans are concerned about the IRS’s increasing militarization and the blurring of lines between a tax agency and traditional law enforcement. The IRS has spent over $35 million on firearms, ammunition, and other military-style equipment since at least 2006, prompting questions about why the agency needs such weapons at all.

According to a job posting on USAJOBS.gov, the IRS is currently looking to fill 360 vacancies for new full-time criminal investigation special agents across all 50 states. The job posting on the IRS Careers website for criminal investigation special agents states that they will be authorized to carry a firearm and must be “willing and able to participate in arrests, execution of search warrants, and other dangerous assignments.”

Senator Ernst’s proposed legislation seeks to disarm the IRS and return taxpayer dollars to address reckless spending in Washington.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."

Now loading...