IRS Releases” Ugly 12″ Tax Scam List for 2023

The Internal Revenue Service ( IRS) has released its annual Dirty Dozen list of tax scams to warn individual citizens, businesses, and tax professionals not to let their guard down as the 2022 tax season draws to a close with less than two weeks left to submit returns.

According to IRS Commissioner Danny Werfel,” Scammers are constantly coming up with new ways to try to take information from payers.” To avoid falling victim to these scams, people should exercise caution and refrain from disclosing sensitive personal information via telephone, email, or social media. Additionally, consumers should always keep in mind to exercise caution if a tax deal seems too good to be true.

According to the company, these frauds and methods take place all year long, not just during tax season. The complete IRS list of potential schemes that citizens are most likely to fall victim to is provided below. The listing includes some new entries from this year.

Claims for Employee Retention Credit

Scammers advertise fake refunds pertaining to the Employee Retention Credit ( ERC ) using aggressive marketing strategies. Citizens must be aware of these blatant attempts by con artists to entice customers with large payouts by promoting their big payments online and on radio. As a result, no one gets paid back while con artists obtain specific information that they will use to commit identity fraud.

Smuggling and Phishing

Phishing is the act of pretending to be a genuine organization in order to get people to divulge personal information. Income fraudsters pose as representatives of businesses like the IRS and entice unwitting members to give away personal information and financial information that will be used to steal identities. Smishing is the practice of phishing over smart email communications. The IRS doesn’t usually get taxpayers via email, text, or social marketing; instead, it usually communicates with them via regular mail.

Online Support

When taxpayers rely on third parties for” help” in opening an IRS online accounts, personal information is easily stolen. The procedure is straightforward, and members are urged to complete the task on their own through the IRS. Gov.

Funds for petrol taxes

By mistakenly claiming the gas tax credit, which is intended for off-highway venture and farming use, dishonest promoters lure taxpayers to raise refunds.

False organizations

Scammers abuse the public’s’s benevolence by pretending to be nonprofits and taking advantage of natural disasters and other problems. Members are not ready for deductions if the donation is not a professional tax-exempt company recognized by the IRS, in addition to losing money and personal info.

False Consultants

As required by law, registered experts have no trouble signing or including their IRS Preparer Tax Identification Number. Therefore, it is a great red flag if the tax preparation chooses not to reveal themselves, and residents should keep an eye out for such experts while also informing the IRS about like providers. Additionally, it is never advisable for citizens to work with someone who charges based on the amount of their tax refund payment and should never sign a blank or insufficient return.

Social Media Funds

To entice citizens with increased refunds, dishonest marketers use strategies like promoting esoteric tax documents like Form W-2 or Form 8944. Many people, despite the fact that the styles are legitimate, are not available for these payments, and as a result of working with the online marketer, they stand to lose their personal information and file inaccurately.

Spearphishing

Spearphishing is a particular type of phishering that targets tax preparers and is particular to an organization or company. Unscrupulous people gain access to client data and the income preparers’ identities as a result of falling for this scam, which enables the criminals to submit false returns.

Provides in a Settlement

Provides in a Settlement are used by people who cannot pay to settle their federal tax debts due to various reasons. Fraudsters take advantage of the situation and offer misleading solutions to taxpayers who do not meet the criteria. Citizens can check their eligibility using this IRS tool.

Taxpayers for High Profits

High-income citizens have been cautioned by the IRS to be afraid of two techniques. Charitable Remainder Annuity Trusts allow people to give to charities with their investments and receive an annual salary. False organizers take advantage of this opportunity to reduce the price of the property’s’s ordinary income and / or capital gain. Monetized Installment Sales are another method used by scammers to facilitate a” sale” in exchange for payment in order to postpone the recognition of gain upon the sale of appreciated property.

Tax-Reduction Plans

According to the IRS, a micro-captive is an insurance company whose homeowners choose to only pay taxes on the captive’s’s investment earnings. However, in an effort to avoid taxes, schemers use micro-captives to register impossible risks and needless duplication of the taxpayer’s’s commercial insurance. Utilizing syndicated restoration easements to increase real estate tax deductions is another fraudulent tax evasion tactic. In normal conditions, a conservation relief that has been donated to charity complies with Internal Revenue Code 170’s’s requirements.

International Plans

People hiding assets in onshore accounts and balances holding electronic goods, such as cryptocurrencies, have been forewarned by the IRS. The organization asserts that it can monitor both digital assets and private transactions from foreign financial accounts. Second, the IRS issues a warning to citizens about incorrectly claiming tax exemptions and avoiding U.S. tax payments through fictitious retirement plans in Malta. Finally, the organization has advised people against using phony healthcare providers in Puerto Rico or many foreign countries and then deducting insurance payments from their taxes.

According to the federal agency, the IRS may contest the transactions as soon as it learns about these schemes and, if found guilty, will visit penalties. For the details they include on their taxes returns, citizens are legally liable.

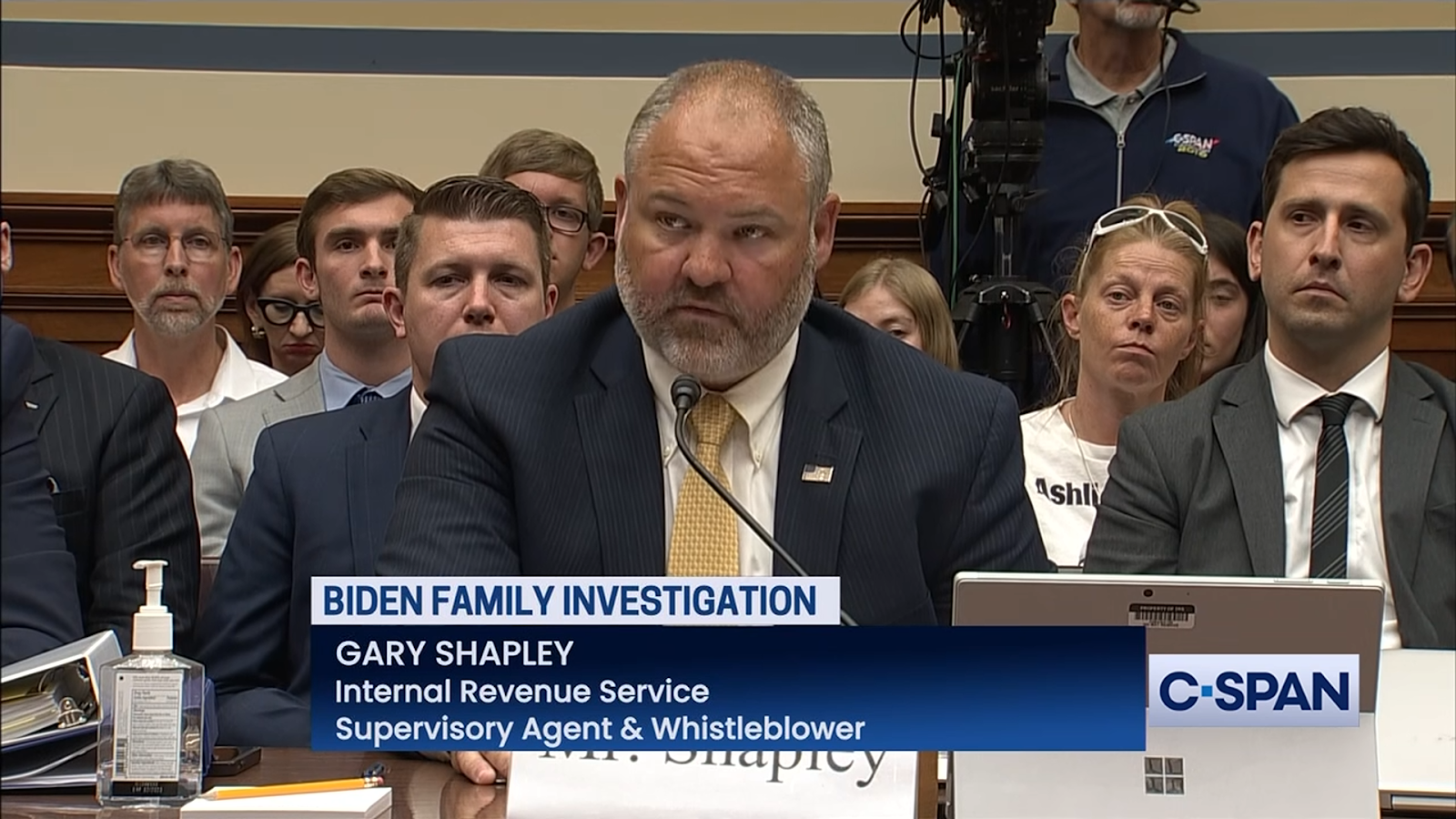

Citizens and tax professionals may take information about deceptive practices to the IRS Whistleblower Office for potential financial compensation.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."

Now loading...