Kentucky Joins Growing Movement To Blacklist ESG Banks

Kentucky The United States joined a growing number conservative states that are beginning to boycott banks they believe discriminate against the fossil fuel industry.

In Compliance with a Kentucky In 2005, law was passed March, State Treasurer Allison Ball Yesterday, a list was released of banks that were included in the yesterday’s release. “are engaged in energy company boycotts.” This List included Wall Street BlackRock, the giants CitibankJPMorgan Chase, BNP ParibasHSBC, six other smaller banks, and HSBC

“Energy is important in Kentucky,” Ball Telled The Epoch Times. “It’s important to the nation, but in Kentucky in particular, about 7.8 percent of our labor force is from the energy sector. We have a lot at stake just because it’s a part of our economy.”

Kentucky’s action to protect its fossil fuel industry follows similar measures by West Virginia And Texas Last year. Kentucky The seventh-largest state for coal production, and 71% of its electricity is dependent on coal-fired power plants. Kentucky It is also responsible to 1.6 percent America’s oil refining capacity and 2 percent of its natural gas storage. More More than half Kentucky Heating their homes with electricity is a common option for households.

“From an ideological perspective, those industries have been have been targeted for the last few years by the ESG movement,” Ball said. “So our state legislature in Kentucky passed last year a bill that said, ‘If you are boycotting the fossil fuel industry, then we don’t want to do business with you as a state.’ We don’t want to use taxpayer dollars to support an ideology that’s actually targeting and harming our signature industries.”

According To the Kentucky SB205 law. The banks on the list are allowed to contest the charge for 60 days and 90 days respectively. “cease engaging in energy company boycotts in order to avoid becoming subject to divestment by state governmental entities.”

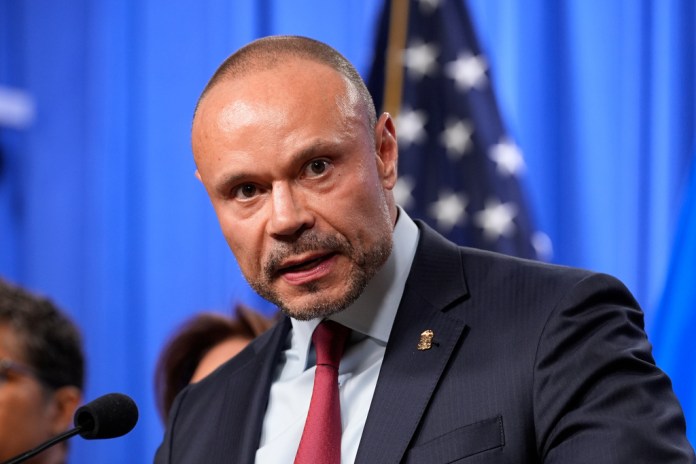

Derek KreifelsThe CEO of the State Financial Officers Foundation, lauded Treasurer Ball’s action, stating: “She and other state financial officers across the country are leading the movement to ensure that money earned by hardworking American families is used in accordance with their values, not weaponized against them.”

Kreifels Telled The Epoch Times He expects that more states will follow his example. Kentucky, Texas, West Virginia In 2023.

“ESG is front and center in this next legislative session,” He said. Issues The range of concerns could be from fossil fuels To firearms, or plains states like Nebraska, Kansas And Iowa Protecting their agricultural industries, which provide food for the nation, is our goal.

“We see the harm that ESG is doing, and we applaud any state official who’s willing to stand up to this scam that is being pushed across America from the White House to Wall Street,” He said.

Many The financial institutions listed below Kentucky’s boycott list have signed pledges to reduce carbon emissions across their lending and investment portfolios as members of international clubs like Climate Action 100+ Glasgow Financial Alliance For Net Zero (GFANZ), Net Zero Banking Alliance (NZBA), the Net Zero Asset Managers Initiative (NZAM). While These firms insist that they are still active investors in fossil fuel companies, and don’t discriminate against them. Vanguard One of the few financial institutions that has withdrawn its membership from these clubs.

“It’s remarkable to me that any of these institutions say that they’re not engaging in boycotts, because they have statements that say that they are, and some of them very explicitly,” Ball sYou can find more information atid. “Blackrock has been very explicit in wanting to cease business with coal companies.”

At a December Hearing before the Texas Representatives from the state senate and the state senate State Street BlackRock testified They join these clubs to discuss climate problems with other members and not to force a agenda on companies whose shares their share. Despite The pledge of members Climate Action 100+ and NZAM to “reach net-zero emissions by 2050 or sooner across all assets under management,” Many asset managers and banks insist that they are not doing this in practice.

BlackRock recently received a three-year exemption From the Federal Energy Regulatory Commission (FERC) to purchase up to 20% of U.S. public utilities. Vanguard Is currently seeking similar approval.

As BlackRock is one of the most powerful asset managers in the entire world. Vanguard, State Street Typically, they don’t divest from fossil fuel corporations but rather buy their shares and work with management to make the necessary changes. Larry Fink, CEO of BlackRock, the world’s largest asset manager, issues an annual letter to CEOs that details what he considers the most important topics for them to focus on in the coming year, which often includes “sustainability” issues.

“We engage with companies in our portfolios; we do not divest,” State Street Global Advisors’ Chief Investment Officer Lori Heinel Originally published at Texas heYou can find more information atring. But Heinel added: “We do not discriminate against companies in any sector, including energy companies … That means we do not tell those energy companies to shift their strategy or to drill more wells.”

In a May letter To the Texas comptroller, JPMorgan Chase wrote: “We provide financial services to many companies that engage in the exploration, production, utilization, transportation, sale or manufacturing of fossil fuel-based energy and intend to do so in the future. Our credit exposure to Oil & Gas as an industry was $42.6 billion as of December 31, 2021.”

Having These firms pledged allegiance for climate-activist causes. However, they are caught between red states who fear for their jobs and industries, and blue states who insist that they honor their pledges to decrease fossil fuel use.

New York City Comptroller Brad Lander, who controls the city’s pension funds, lambasted BlackRock, which stated that, despite its climate action pledges, “BlackRock now abdicates responsibility for driving net zero alignment in its own portfolio by saying that it does not ask companies to set specific emissions targets, and that its participation in NZAMi does not mean BlackRock is setting or meeting any net zero targets.”

In Last week, a scathing email was sent SeptemberIn which Lander Threatened to withdraw New York City He charged that BlackRock would pay for pension funds. “the fundamental contradiction between BlackRock’s statements and actions is alarming. BlackRock cannot simultaneously declare that climate risk is a systemic financial risk and argue that BlackRock has no role in mitigating the risks that climate change poses to its investments by supporting decarbonization in the real economy.”

BlackRock, State Street, VanguardThe, also known as “Big Three” Asset managers collectively hold 90 percent of S&P 500 company’s largest shares. TogetherThey have approximately $20 trillion in retirement assets and investments.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."