Reddit Investors Now Taking Losses As GameStop Stock Price Tumbles, SEC Investigating Potential ‘Manipulation’

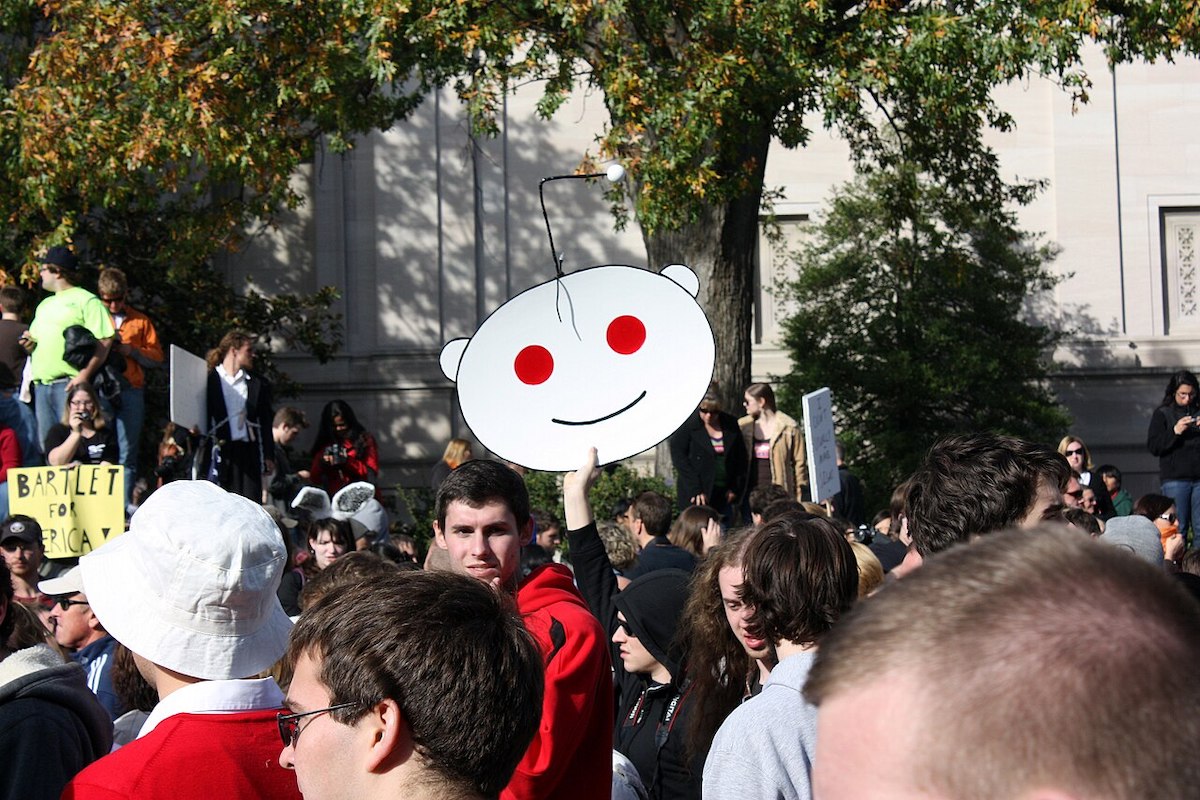

Some Reddit investors are now showing losses on GameStop stock, but many are refusing to sell their shares, even given the stock’s sudden tumble, over plans to turn the social media-driven stock surge into a long-term war on Wall Street.

The SEC, though, is concerned that Reddit’s investors may have been manipulated.

Forbes reports that GameStop is now down nearly 80% off its high last week — a shocking $400 per share, far over its recent low of $10 per share — and some investors who piled on the stock surge are now seeing losses in the millions, but at least one major Reddit investor told the magazine that the risk could be worth it in the long run.

“GameStop investors have watched what could’ve been wild, once-in-a-lifetime gains slip through their fingers, many portfolios dropping by tens of thousands of dollars—in some cases, millions of dollars—almost overnight,” the outlet noted, careful to suggest that most of the r/WallStreetBets investors bought GameStop so low that their portfolios still show gains.

“In the latest unexpected chapter of the GameStop saga, the majority of the Redditors are upbeat, many declaring an absolute dedication to holding onto the company’s shares, consequences be damned, the opposite reaction you’d expect from investors recently whipsawed through a financial mania, ” the site reports.

“They see their continued investment as a perpetual indictment of Wall Street, driven by fury over brokerages such as Robinhood and Interactive Brokers limiting their ability to trade GameStop,” Forbes said. “They hope it draws the attention of authorities willing to mete out immediate punishment and think out long-term reforms to reduce the advantage institutions have over ordinary investors.”

The Securities and Exchange Commission is poised to investigate the entire GameStop stock surge incident, but Bloomberg reports Thursday that it seems particularly interested in whether fraudulent posts on r/WallStreetBets may have lured investors into purchasing GameStop stock.

“U.S. Securities and Exchange Commission investigators are combing social media and message board posts for signs that fraud played a role in dizzying stock swings for GameStop Corp., AMC Entertainment Holdings Inc., and other companies, according to people familiar with the matter,” Bloomberg notes. “The scrutiny is being done in tandem with a review of trading data to assess whether such posts were part of a manipulative effort to drive up share prices, said the people, who requested anonymity because the review isn’t public. The regulator is specifically on the hunt for misinformation meant to improperly tilt the market, the people said.”

The SEC is reportedly looking at “bot activity,” but also at “professional investors who either took advantage of the Reddit-fueled frenzy or helped hype it” — or investors who had an interest in seeing Wall Street short-sellers suffer. They also may be investigating this aspect of the incident because while the SEC does not have jurisdiction over message boards, it does have jurisdiction over individuals, specifically “people accused of making false claims about stocks online.”

The Daily Wire is one of America’s fastest-growing conservative media companies and counter-cultural outlets for news, opinion, and entertainment. Get inside access to The Daily Wire by becoming a member.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."