Sens. Sanders and Warren to Give Billionaires Free Pass After Decades of Knocking Tax Loopholes

NEWYou can now listen to Fox News articles!

Vermont Sen. Bernie Sanders, an independent, and Massachusetts Democratic Sen. Elizabeth Warren, who have a history of knocking financial “loopholes” used by wealthy individuals and corporations, are set to vote on the Inflation Reduction Act after the measure’s carried interest tax provision that targeted billionaires was removed.

The social spending and tax measure — which is largely scaled back from the initial $3 trillion-plus “Build Back Better” bill — spends $433 billion and would raise $739 billion in revenue, according to Democrats. It is expected to rapidly pass through the Senate after Sen. Kyrsten Sinema, D-Ariz., lobbied to remove the provision as part of her agreement to back the bill.

While both Sanders and Warren are likely to vote in favor of the legislation, announced last week by West Virginia Democratic Sen. Joe Manchin and Senate Majority Leader Chuck Schumer, the pair of progressive senators have repeatedly criticized tax loopholes over the years that are used by wealthy Americans, including the carried interest loophole.

In 2015, Sanders and Warren, along with six others, originally co-sponsored the Carried Interest Fairness Act, a measure introduced in the Senate that would have closed the carried interest loophole.

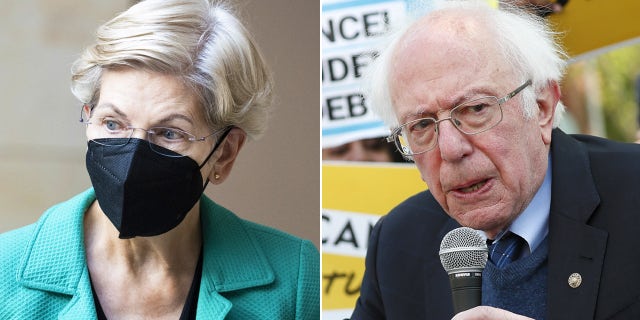

Sens. Elizabeth Warren, D-Mass., and Bernie Sanders, I-Vt., have a history of knocking loopholes used by the wealthy, including the carried interest loophole.

(Paul Morigi for We The 45 Million, Tom Williams/CQ-Roll Call Inc via Getty Images)

Last September, amid ongoing negotiations regarding the budget reconciliation bill, Sanders claimed the measure would “end the days of tax loopholes and evasions” that are used by billionaires.

“Let me be as clear as I can be. The budget reconciliation bill is PAID FOR. How will that happen? We will finally end the days of tax loopholes and evasions by the billionaire class of this country,” Sanders wrote in a tweet. “Yes, they will finally pay their fair share of taxes.”

Just prior to announcing his second presidential bid in 2019, Sanders addressed the “rigged tax code” in America and took aim at wealthy Americans who he insisted have dodged adequate tax percentages.

“We have a rigged tax code that has essentially legalized tax-dodging for large corporations and the world’s wealthiest individuals,” Sanders wrote in a January 2019 tweet. “It is time to end these egregious loopholes and make the wealthy pay their fair share.”

INFLATION LIKELY TO REMAIN HIGH, DESPITE MANCHIN’S INFLATION REDUCTION ACT, AMERICANS SAY

In a 2018 tweet, Sanders took aim at former President Donald Trump, claiming that he failed to live up to a campaign promise to tackle the “egregious carried interest loophole,” and that his “disgraceful tax bill did nothing to address it.”

Echoing several of the viewpoints held by Sanders, Warren has made a name for herself when it comes to calling out wealthy Americans like Elon Musk and corporations like Amazon.

“Loopholes, deductions, exemptions. There are lots of benefits to being a corporation like Amazon – which made over $10 billion in profits and paid $0 in federal corporate income taxes last year,” Warren wrote in a June 2019 tweet during her campaign for the presidency.

CLICK HERE TO GET THE FOX NEWS APP

Warren also claimed in a 2017 tweet that “real tax reform would close up loopholes for the rich [and] put working families first.”

Fox News Digital reached out to Sanders and Warren to see whether they intend to still vote in favor of the measure and did not receive a response from either office.

Fox News’ Joe Schoffstall contributed to this article.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."

Now loading...