Treasury secretary called on to recuse herself from advising Biden on Reddit rebellion

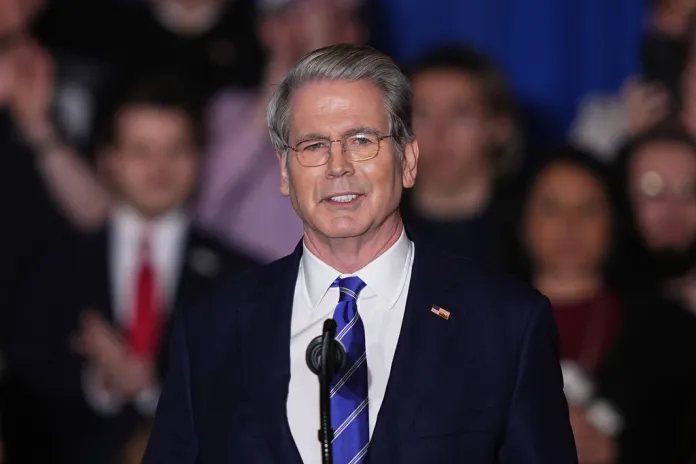

Treasury Secretary Janet Yellen listens during a meeting with President Joe Biden in the Oval Office of the White House, Friday, Jan. 29, 2021, in Washington. (AP Photo/Evan Vucci)

OAN Newsroom

UPDATED 10:54 AM PT – Friday, January 29, 2021

Secretary of the Treasury Janet Yellen has come under fire after it was revealed she received payments from a Wall Street hedge fund known as Citadel LLC, which may have played a role in Robinhood’s decision to cancel purchases of shares in retail companies.

According to Yellen’s public financial disclosures, she was paid over $800,000 to give speeches to Citadel. Some may wonder why this is significant even after White House press secretary Jen Psaki called Yellen one of the world’s leading experts on economics.

“Separate from the GameStop issue, the Secretary of the Treasury is one of the world renowned experts on markets…on the economy,” Psaki stated. “It shouldn’t be a surprise to anyone she was paid to giver her perspective and advise before she came into office.”

The issue is Citadel Group has allegedly initiated one of the most egregious market manipulations in U.S. history by pushing day trading app Robinhood to halt all purchases of retail stocks amid a massive surge.

The surge happened when novice day traders realized the vast majority of stocks held in retail companies like GameStop, AMC and Express were shorts held by major hedge funds who expected the stocks to fail.

However, Reddit users on the WallStreetBets forum realized they could get thousands of people to buy the stocks, in turn, triggering a massive surge.

“Right now, it is so easy, free, readily available, completely gamified on peoples cell phones,” explained Jaime Rogozinski, founder of the WallStreetBets page. “They are able to instantly get in there and participate, and start using these sophisticated leverage tools that they’re able to exploit the asymmetry of money right.”

On Thursday morning, Robinhood decided there was too much “market volatility” and stopped letting users buy the booming stocks.

As it turns out, one of the major losers in the surge was a company called Melvin Capital, which was a firm that lends out shorts for stocks like GameStop. The Reddit user surge set them up for a major loss in all the retail stocks they were betting against.

FILE – In this May 7, 2020 file photo, a GameStop store is seen in St. Louis. (AP Photo/Jeff Roberson, File)

As a result, Citadel LLC bailed out Melvin Capital with a payment of $2 billion, according to CEO Gabriel Plotkin. Why would Citadel bail out Melvin Group’s shorts right before Robinhood banned sales of the retail stocks?

The answer: Robinhood makes their trades through companies like Citadel. For instance, If you buy a share of Tesla on Robinhood, they send the order to Citadel and both companies benefit from the sale.

With Robinhood’s move, stocks like GameStop are dropping, which could lead to those shorts finally paying off for the giant firms on Wall Street. Officials call this market manipulation and the Senate Banking Committee has already decided to hold a hearing on the freezing of the retail stocks.

When people expect the government to step in and keep major firms from manipulating the markets, it can be quite concerning to find out the President’s own Treasury Secretary has been paid hundreds of thousands of dollars from the company at center of the controversy — Citadel.

Americans will now have to wait and see if Janet Yellen recuses herself from advising Joe Biden on policy surrounding this massive controversy.

MORE NEWS: Bipartisan group of lawmakers call for hearing into Robinhood app for restricting small investors

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."