Trump support for his own tax law provision on the rocks with – Washington Examiner

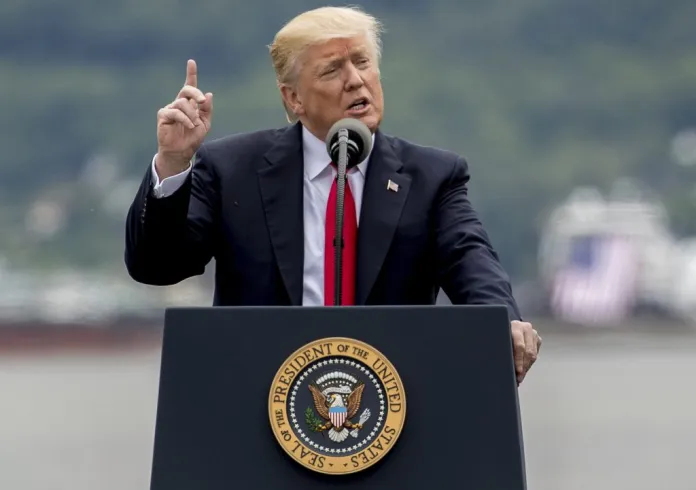

Former President Donald Trump, now the Republican presidential nominee for 2024, has expressed support for a bipartisan initiative by New York’s congressional delegation to expand federal deductions for state and local taxes (SALT). This marks a significant shift from his previous stance under the 2017 Tax Cuts and Jobs Act, which imposed a $10,000 cap on these deductions, disproportionately affecting high-tax states like New York.

The SALT deduction cap was intended to raise revenue for tax cuts for corporations and was seen as a punitive measure against blue states. In California, for example, taxpayers faced an additional $12 billion tax burden due to this cap. Critics, including Democratic governors, condemned the change as politically motivated.

Recently, Trump indicated at a campaign rally that he would work to eliminate this cap, a move he claims would benefit middle-class voters in states like New York, Pennsylvania, and New Jersey. As he campaigns against Vice President Kamala Harris, he aims to appeal to voters by promising to restore the SALT deductions and lower their tax burden. This shift is viewed as a strategic move to garner support from constituents in swing districts who advocate for changes to the SALT deduction cap.

Trump support for his own tax law provision on the rocks with

NEW YORK — Former President Donald Trump may live in Florida now, but he is embracing his New York roots.

The Queens born-and-bred 2024 Republican presidential nominee said he agrees with a bipartisan push by members of New York’s congressional delegation to support expanding federal deductions for state and local taxes paid. That is a reversal of his policies and a major boost to high-tax states such as New York.

The proper cap level of SALT deduction, or if there should be one at all, has been a long-running intra-Republican source of conflict since the enactment of the 2017 Tax Cuts and Jobs Act. With Republicans in full control of the federal government at the time, the TCJA included a $10,000 cap on SALT deductions.

Before that, people could deduct all their state income and local property taxes on federal returns. High-tax blue states led by Democrats were particularly slammed by the GOP legislation. But it wasn’t a big deal in many red states with low taxes or no income levies at all, such as Texas and Florida.

For instance, the average SALT deduction in California had exceeded $18,400. In the cap’s first year, Californians who itemized deductions were hit with a total extra tax burden of $12 billion, the state Franchise Tax Board reported at the time.

In part, the cap was designed to punish Democratic states that had high taxes and higher government services. It also was a revenue-raiser for some of the other provisions in the TCJA, such as slashing the corporate tax rate. The SALT cap stayed in the TCJA partly at the behest of then-House Speaker Paul Ryan, the Wisconsin Republican who frequently clashed with Trump, whom he is not voting for in November, instead writing in a different Republican.

Congressional Democrats and allies, who opposed the TCJA overall, leveled particular criticism of the SALT change. California’s then-Gov. Jerry Brown charged that Republican congressional leaders were “wielding their power like a bunch of Mafia thugs.”

In 2021, with President Joe Biden in office, Gov. Gavin Newsom (D-CA) and six other Democratic governors sent the White House a letter urging him and Congress, at the time under unified Democratic control, to “undo the cap.”

“Capping SALT was based on politics, not logic or good government,” the governors contended. “This assault disproportionately targeted Democratic-run states.”

The Biden White House, though, had other priorities, and nothing came of it.

Blue-state Republicans back SALT change

Some congressional Republicans have long called for SALT changes. A group of Republican lawmakers in places such as New York and California has been adamant in pushing for that cap to be raised or eliminated. The group’s effort appeared to bear fruit on Sept. 17 when Trump signaled that he supports changes to the cap.

The former president, at a campaign rally in Uniondale, Long Island, said he would seek to eliminate the limit on state and local tax deductions that he imposed in his signature 2017 tax law.

“Going to restore SALT,” he said during his rally, adding that the move would “save thousands of dollars for residents of New York, Pennsylvania, New Jersey.”

Trump, facing a tough fight for a second, nonconsecutive presidential term against Vice President Kamala Harris, seems to see the SALT cap repeal as politically advantageous in wooing middle-class voters.

“I will turn it around, get SALT back, lower your taxes, and so much more,” Trump recently wrote on his social media platform, Truth Social.

That’s music to the ears of House Republicans in swing districts, who have lately been particularly vocal in pushing for a lifting of the SALT cap deduction. Many are among the 18 GOP representatives in districts where, in 2020, Biden won more votes than Trump. They are being heavily targeted ahead of the Nov. 5 elections by congressional Democrats, who need to net four seats to win a majority in the 435-member House.

“The $10,000 SALT deduction cap is a slap in the face to middle-class families in #CA27. With the highest taxes and cost of living, Californians deserve better,” Rep. Mike Garcia (R-CA) wrote in a Sept. 3 Instagram post.

Garcia is a top Democratic target in the 27th Congressional District in northern Los Angeles County, covering the cities of Lancaster, Palmdale, and Santa Clarita. Biden, in 2020, would have won the district over Trump 55.1% to 42.7%.

“As a founding member of the bipartisan SALT Caucus, I’m committed to addressing this unfair cap and bringing real relief to our hardworking families,” Garcia added.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."