With New IRS Tax Brackets Taking Effect, Your Paycheck May be Larger

Check out what’s clicking on FoxBusiness.com

Higher federal income tax brackets and standard deductions are now in effect, potentially giving Americans a chance to increase their take-home pay in 2023 and shield more of their income from the Internal Revenue Service.

The IRS announced the higher limits for the federal income tax bracket and standard deductions in October. The increase is intended to avoid a phenomenon known as “bracket creep,” which happens when taxpayers are pushed into higher-income brackets even though their purchasing power is essentially unchanged due to steeper prices for most goods.

The IRS makes such adjustments annually, but in times of painfully high inflation, the increases are more significant and impactful for taxpayers. Inflation hovered around a four-decade high for much of 2022, hitting a high of 9.1% in June and falling slightly to 7.1% in November – still about three times the pre-pandemic average.

This year, the tax brackets are shifting higher by about 7%.

STILL MISSING YOUR TAX REFUND? THE IRS WILL SOON PAY YOU 7% INTEREST

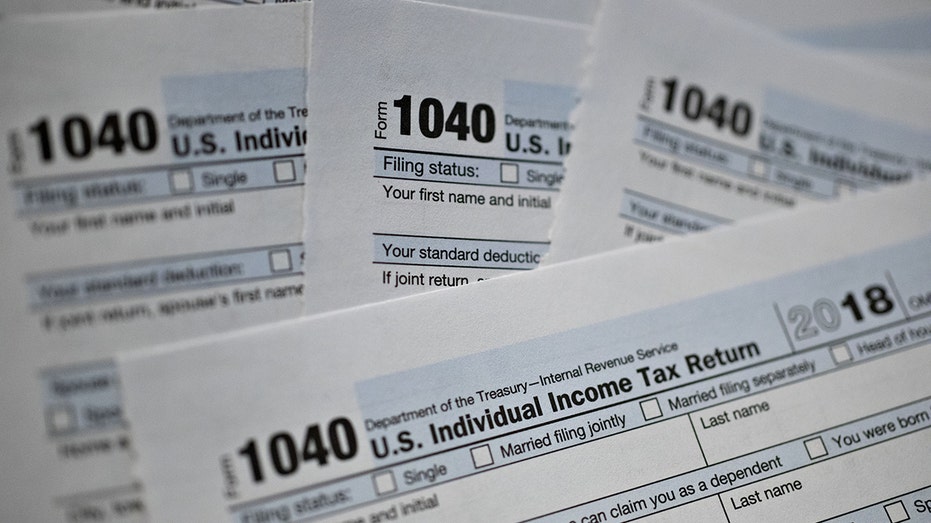

The IRS makes adjustments annually, but in times of painfully high inflation, the increases are more significant and impactful for taxpayers. (Al Drago/Bloomberg via Getty Images / Getty Images)

The higher thresholds where tax rates take effect could mean savings for millions of Americans across all income brackets.

Here is a closer look at what taxpayers need to know this year:

IRS SAYS YOUR TAX REFUND COULD BE SMALLER IN 2023 – HERE’S WHY

Tax brackets for single individuals:

The IRS is increasing the tax brackets by about 7% for both individual and married filers across the different income spectrums. The top tax rate remains 37% in 2023.

- 10%: Taxable income up to $11,000 or less

- 12%: Taxable income over $11,000

- 22%: Taxable income over $44,725

- 24%: Taxable income over $95,375

- 32%: Taxable income over $182,100

- 35%: Taxable income over $231,250

- 37%: Taxable income over $578,125

The higher thresholds where tax rates take effect could mean savings for millions of Americans across all income brackets. (Daniel Acker/Bloomberg via Getty Images / Getty Images)

Tax brackets for joint filers:

- 10%: Taxable income up to $22,000

- 12%: Taxable income over $22,000

- 22%: Taxable income over $89,450

- 24%: Taxable income over $190,750

- 32%: Taxable income over $364,200

- 35%: Taxable income over $462,500

- 37%: Taxable income over $693,750

Other tax provisions

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The IRS increased the thresholds for several other provisions, including the earned income tax credit amount, with families now eligible to receive $7,430 if they have three or more qualifying children. That is up from $6,935 for tax year 2022.

Employees can also contribute more to their health flexible spending accounts, with the maximum contribution rising to $3,050.

" Conservative News Daily does not always share or support the views and opinions expressed here; they are just those of the writer."

Now loading...